What’s Fueling Executive Summary Biostimulants Market Size and Share Growth

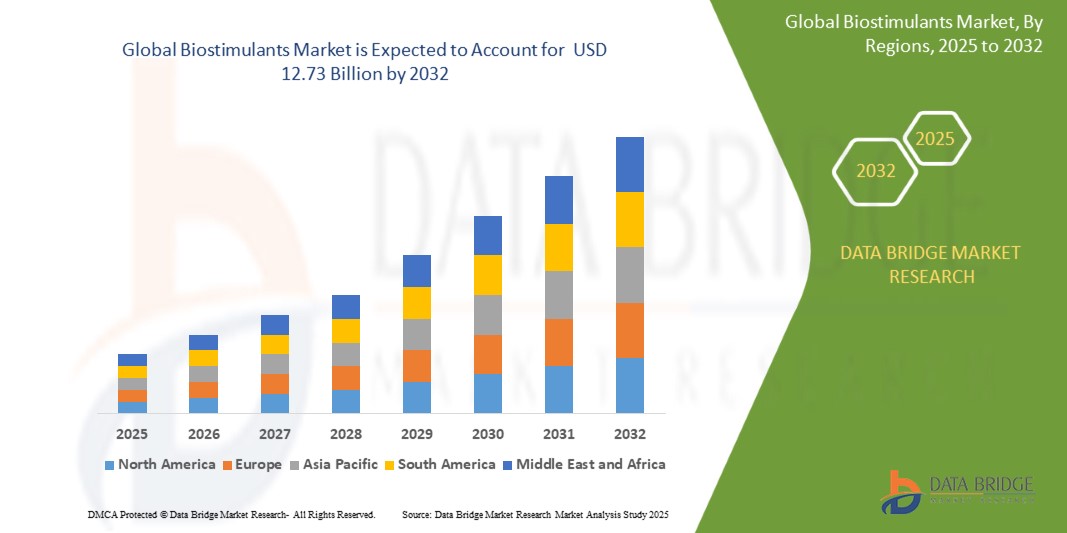

- The global biostimulants market size was valued at USD 5.18 billion in 2024 and is expected to reach USD 12.73 billion by 2032, at a CAGR of 11.90% during the forecast period.

An influential Biostimulants Market document supports in achieving a sustainable growth in the market, by providing a well-versed, specific and most relevant product and market information. This report provides details about historic data, present market trends, future product environment, Market strategies, technological innovation, upcoming technologies, emerging trends or opportunities, and the technical progress in the related industry. Biostimulants Market report also takes into account strategic profiling of the major players in the market, all-inclusive analysis of their basic competencies, and hence keeps competitive landscape of the market in front of the client.

The steadfast Biostimulants Market research report underlines an insightful overview of product specification, technology, applications, product type and production analysis considering major factors such as revenue, cost, and gross margin. The report is a useful resource which provides present as well as upcoming technical and financial details of the industry to 2030. The market drivers and restraints have been examined using SWOT analysis. To provide clients with the best in the industry, a team of experts, skilled analysts, dynamic forecasters and knowledgeable researchers work meticulously while preparing Biostimulants Market business report.

Navigate the evolving landscape of the Biostimulants Market with our full analysis. Get your report:

https://www.databridgemarketresearch.com/reports/global-biostimulants-market

Biostimulants Market Outlook & Forecast

Segments

- Type: The biostimulants market can be segmented based on type into natural and synthetic biostimulants. Natural biostimulants are derived from natural sources such as plant extracts, seaweed extracts, beneficial microbes, and others. On the other hand, synthetic biostimulants are chemically synthesized compounds that mimic the effects of natural biostimulants.

- Application: In terms of applications, the market can be categorized into foliar treatment, soil treatment, and seed treatment. Foliar treatment involves the application of biostimulants directly onto the leaves of plants. Soil treatment refers to the application of biostimulants to the soil to enhance nutrient uptake and improve plant growth. Seed treatment involves coating seeds with biostimulants to promote germination and early growth.

- Crop Type: The global biostimulants market can also be divided based on crop type into fruits & vegetables, cereals & grains, oilseeds & pulses, and others. Different crop types have varying requirements for nutrients and growth stimulants, driving the demand for biostimulants across a wide range of crops.

Market Players

- BASF SE: One of the leading players in the global biostimulants market, BASF SE offers a wide range of biostimulant products aimed at improving crop productivity and resilience to environmental stress.

- Isagro S.p.A.: Isagro S.p.A. is another key player in the market, known for its innovative biostimulant formulations that help farmers optimize plant growth and maximize yields.

- Valagro S.p.A.: Valagro S.p.A. is a prominent player specializing in biostimulant products derived from natural sources, offering sustainable solutions for improving agricultural productivity.

- Koppert Biological Systems: Koppert Biological Systems is a well-established company that provides biological solutions, including biostimulants, to promote healthy plant growth and reduce the reliance on chemical inputs.

- UPL Limited: UPL Limited is a major player in the biostimulants market, offering a diverse portfolio of biostimulant products designed to support sustainable agriculture practices and improve crop performance.

The global biostimulants market is characterized by the presence of several key players, each competing to innovate and develop novel solutions to meet the growing demand for sustainable agricultural practices. The market segmentation based on type, application, and crop type provides a comprehensive understanding of the diverse needs and preferences of farmers worldwide. As the focus on eco-friendly agricultural practices and increasing awareness about the benefits of biostimulants continue to rise, the market is expected to witness significant growth in the coming years.

The global biostimulants market is poised for substantial growth in the foreseeable future, driven by a mounting emphasis on sustainable agricultural practices and the increasing adoption of environmentally friendly solutions. The market is witnessing a surge in demand for biostimulants that offer enhanced crop productivity, improved nutrient uptake, and resilience to environmental stressors. As farmers worldwide seek to optimize yields while minimizing the use of chemical inputs, the market players are focusing on developing innovative formulations and solutions to meet these evolving needs. The competition among key players such as BASF SE, Isagro S.p.A., Valagro S.p.A., Koppert Biological Systems, and UPL Limited is intensifying as they strive to differentiate themselves through advanced technologies and sustainable product offerings.

The segmentation of the biostimulants market based on type, application, and crop type plays a crucial role in understanding the diverse requirements of farmers across different regions and crop varieties. Natural biostimulants derived from plant extracts, seaweed extracts, and beneficial microbes are gaining traction due to their sustainable and eco-friendly nature, while synthetic biostimulants continue to cater to specific needs where natural alternatives may be limited. The application of biostimulants through foliar treatment, soil treatment, and seed treatment offers a versatile approach to enhancing plant growth and overall crop health, providing farmers with effective tools to optimize their agricultural practices.

Crop type segmentation further highlights the varied demands for biostimulants across different crops such as fruits & vegetables, cereals & grains, and oilseeds & pulses. Each crop type presents unique challenges and opportunities for biostimulant manufacturers to develop tailored solutions that address specific nutrient requirements and growth stimulant needs. By catering to a diverse range of crops, market players can tap into a wide array of farming practices and regional preferences, expanding their market reach and enhancing their competitive position.

As the global biostimulants market continues to evolve, partnerships, research collaborations, and investments in R&D are likely to drive innovation and product development in the industry. The shift towards sustainable agriculture, coupled with the mounting pressure to reduce chemical residues in food production, is expected to fuel the growth of the biostimulants market in the coming years. With a strong emphasis on promoting plant growth, increasing crop yields, and ensuring environmental sustainability, biostimulants are poised to play a pivotal role in shaping the future of agriculture worldwide.The global biostimulants market is witnessing significant growth driven by the increasing focus on sustainable agricultural practices and the rising demand for environmentally friendly solutions. Key players in the market such as BASF SE, Isagro S.p.A., Valagro S.p.A., Koppert Biological Systems, and UPL Limited are actively developing innovative formulations to meet the evolving needs of farmers worldwide. The competition among these players is intensifying as they strive to differentiate themselves through advanced technologies and sustainable product offerings.

The segmentation of the biostimulants market based on type, application, and crop type is crucial in understanding the diverse requirements of farmers and cater to different regions and crop varieties. Natural biostimulants, derived from plant extracts, seaweed extracts, and beneficial microbes, are gaining popularity due to their eco-friendly nature. Meanwhile, synthetic biostimulants continue to meet specific needs where natural alternatives may be limited. The application of biostimulants through foliar treatment, soil treatment, and seed treatment provides farmers with versatile tools to enhance plant growth and overall crop health effectively.

Crop type segmentation further highlights the varied demands for biostimulants across different crops, including fruits & vegetables, cereals & grains, oilseeds & pulses, and others. Each crop type presents unique challenges and opportunities for biostimulant manufacturers to develop tailored solutions that address specific nutrient requirements and growth stimulant needs. By catering to a diverse range of crops, market players can expand their market reach and strengthen their competitive position by tapping into various farming practices and regional preferences.

Looking ahead, partnerships, research collaborations, and investments in R&D are expected to drive innovation and product development in the biostimulants market. The shift towards sustainable agriculture and the increasing pressure to reduce chemical residues in food production will continue to fuel the growth of the biostimulants market in the coming years. With the focus on promoting plant growth, increasing crop yields, and ensuring environmental sustainability, biostimulants are poised to play a vital role in shaping the future of agriculture worldwide. The market is likely to witness further advancements in technology, formulation techniques, and sustainable solutions to meet the evolving needs of farmers and align with global trends towards eco-friendly farming practices.

Inspect the market share figures by company

https://www.databridgemarketresearch.com/reports/global-biostimulants-market/companies

Biostimulants Market Research Questions: Country, Growth, and Competitor Insights

- What is the full scope of the Biostimulants Market valuation?

- What is the average growth rate expected post-2025?

- What segmentation variables are most impactful?

- Which firms lead in sustainability within the Biostimulants Market?

- What product categories are showing exponential growth?

- Which countries are expanding their consumer base?

- What is the most rapidly developing regional economy?

- Which nations have the highest investment inflow?

- What region is setting pricing benchmarks?

- What are the innovation challenges facing this Biostimulants Market industry?

Browse More Reports:

Global Cutaneous Lupus Erythematosus Market

Global Data Center Cooling Market

Global Dental Implants and Prosthetics Market

Global Dental Laboratories Service Market

Global Dental Robotics and Digital Solutions Market

Global Digital Talent Acquisition Market

Global Edible Packaging Market

Global Education Smart Display Market

Global Electro Hydraulic Servo Valve Market

Global EMC Filtration Market

Global Epoxy Composites Market

Global Essential Oil Extraction Market

Global Facial Recognition Market

Global Feed Protein Market

Global Folliculitis Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com